Before turning to the data, I want to begin with a sincere thank you. Each year, I am reminded how much I enjoy what I do and, more importantly, the people I get to do it with. I am genuinely grateful for the relationships built, the conversations had, and the trust extended along the way. It is a true privilege to be part of these moments. The data that follows provides valuable context, but it is the people behind the numbers who make this work meaningful. Real estate is more than the buying and selling of properties; it is also about creating a sense of place and building community.

Against a backdrop of ongoing economic uncertainty, shifting interest rate expectations, and broader global factors, Princeton’s residential real estate market remained resilient in 2025. The year reflected steady activity and continued demand, alongside signs of normalization after several years of extraordinary, pandemic-driven market movements.

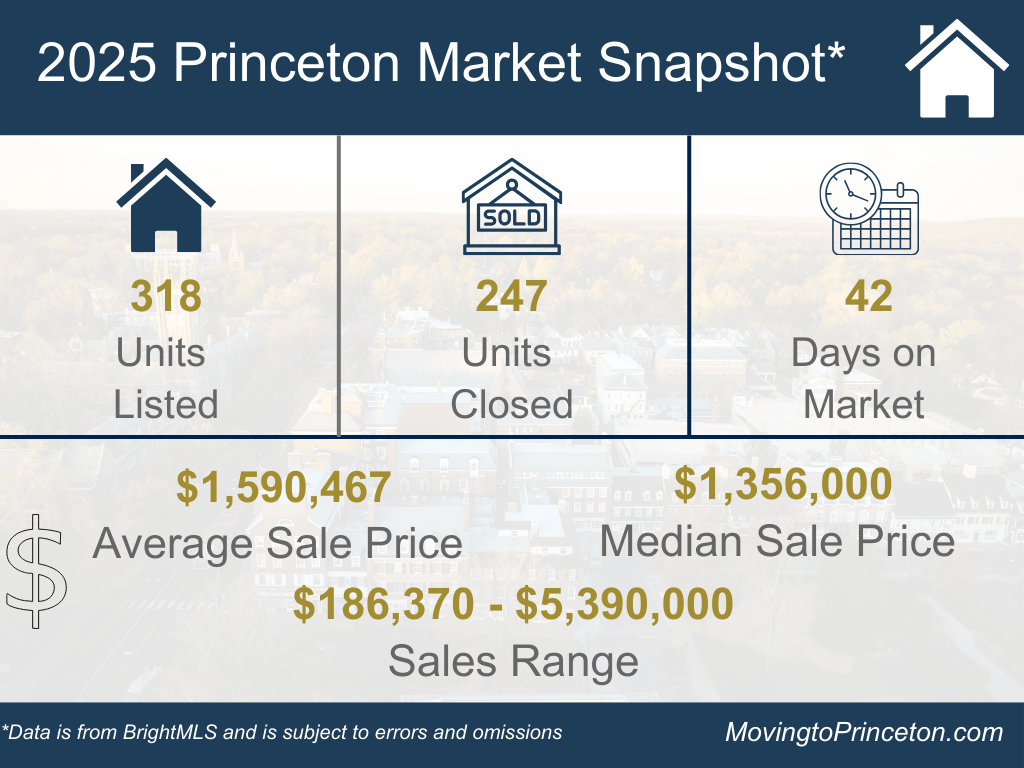

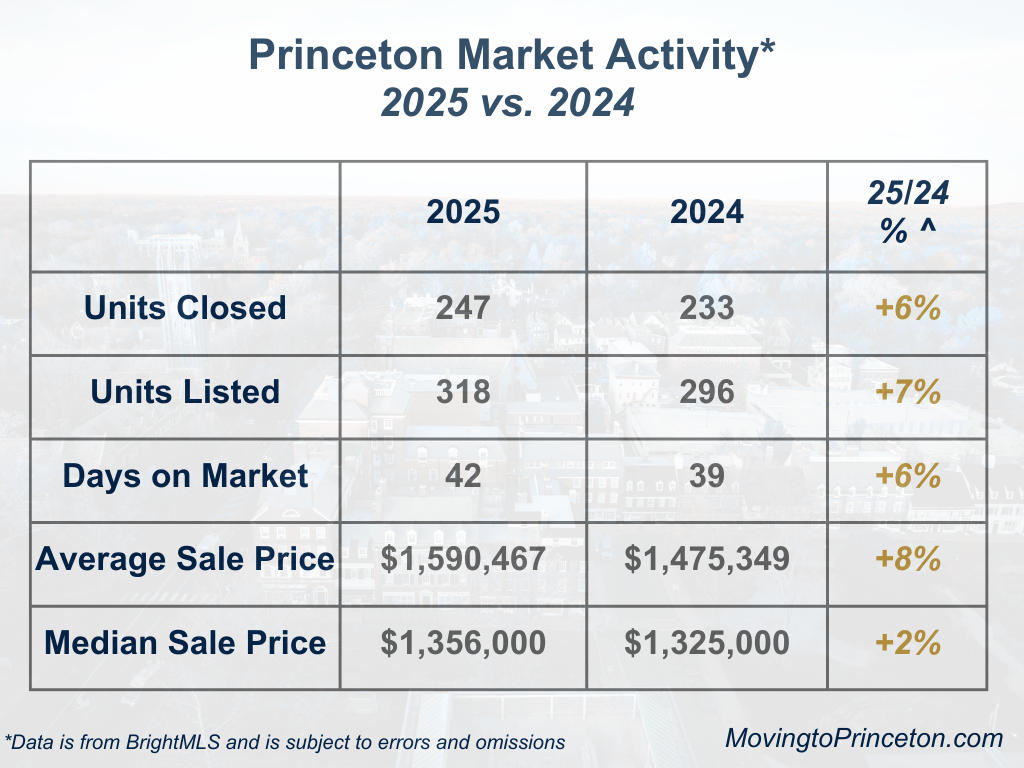

In total, 247 homes closed, representing a +6% year-over-year increase, while 318 properties were listed, up +8% from 2024. Days on Market averaged 42, modestly higher than the prior year, signaling a market that continues to move efficiently but with slightly more buyer deliberation. Pricing remained strong in 2025. The Average Sale Price reached $1,590,467, an increase of approximately +8%, while the Median Sale Price rose to $1,356,000, up about +2%. In 2025, activity increased, pricing continued to rise, and homes took slightly longer to sell compared to 2024.

As always, it is essential to note that sales occur outside BrightMLS every year, often in the high-end, and this data is not included in my analysis.

The increase in inventory and transaction volume in 2025, coupled with homes taking slightly longer to sell compared to 2024, suggests a broadening market rather than a cooling one. Buyers remained engaged, but more selective, and sellers who thoughtfully approached pricing and preparation continued to see strong outcomes, without the extreme urgency that defined earlier years. Success increasingly depended on thoughtful preparation and strategy rather than speed alone.

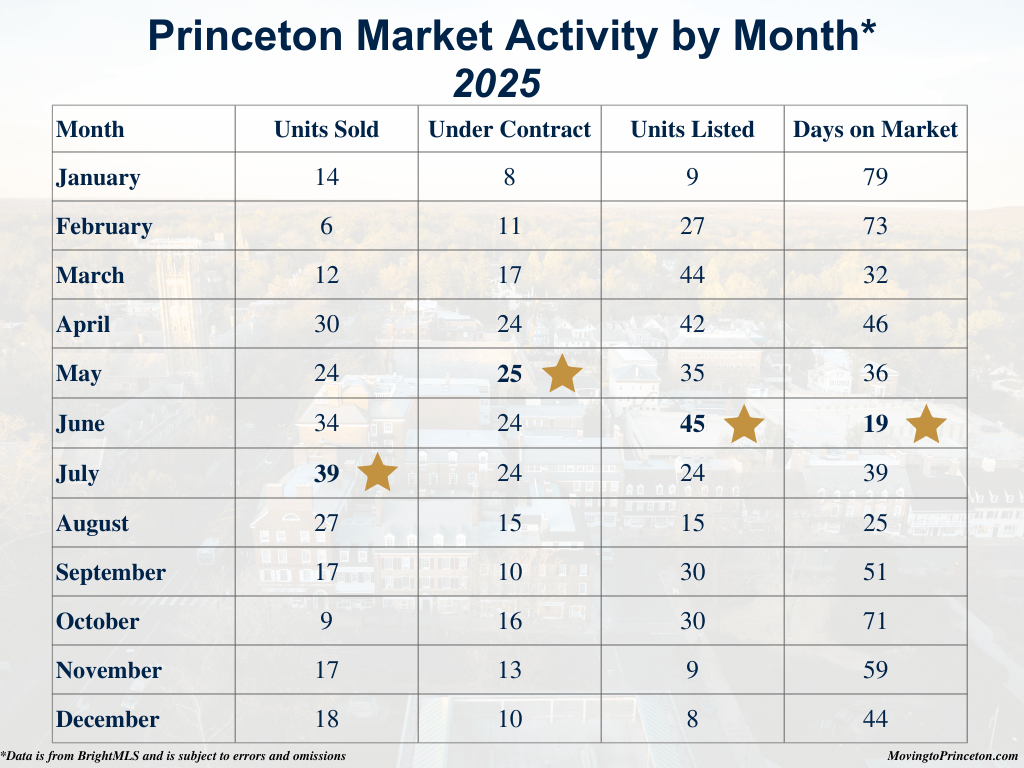

Seasonal patterns followed a familiar rhythm, with market activity concentrated between spring and early summer. From April through July, both new listings and homes going under contract remained consistently strong, and Days on Market were among the fastest of the year. Homes that were well prepared and correctly priced during the peak season tended to sell efficiently, while listings introduced earlier or later in the year often took longer and required more careful positioning.

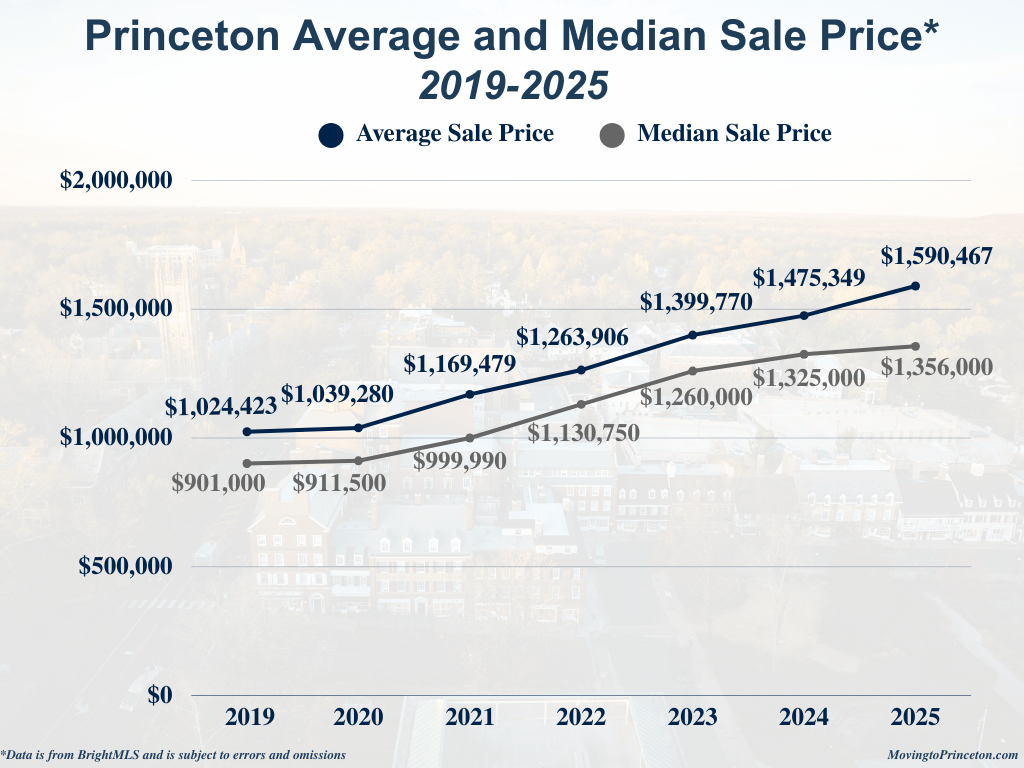

Over the past six years, both the Average and Median Sale Prices have increased steadily, with robust gains between 2020 and 2023. After several years of rapid appreciation, the pace of price growth became more measured heading into 2024. In 2025, average prices rose faster than median prices, suggesting that higher-priced sales were doing more of the work in driving overall pricing.

The composition of Princeton home sales has shifted meaningfully since 2019, when the majority of transactions occurred below $1M. By 2025, the $1M–$2M segment represented the largest share of sales, while higher price points accounted for a substantially greater portion of overall activity. Since 2019, sales between $2M and $3M have grown from roughly 5% to 17% of total transactions, and homes selling above $3M have increased from less than 1% to more than 7% of all closed sales. This shift helps explain why pricing has remained resilient, even as overall transaction volume remains below historic highs. The market has moved up, with higher-priced homes making up a much larger share of overall sales than they did just a few years ago.

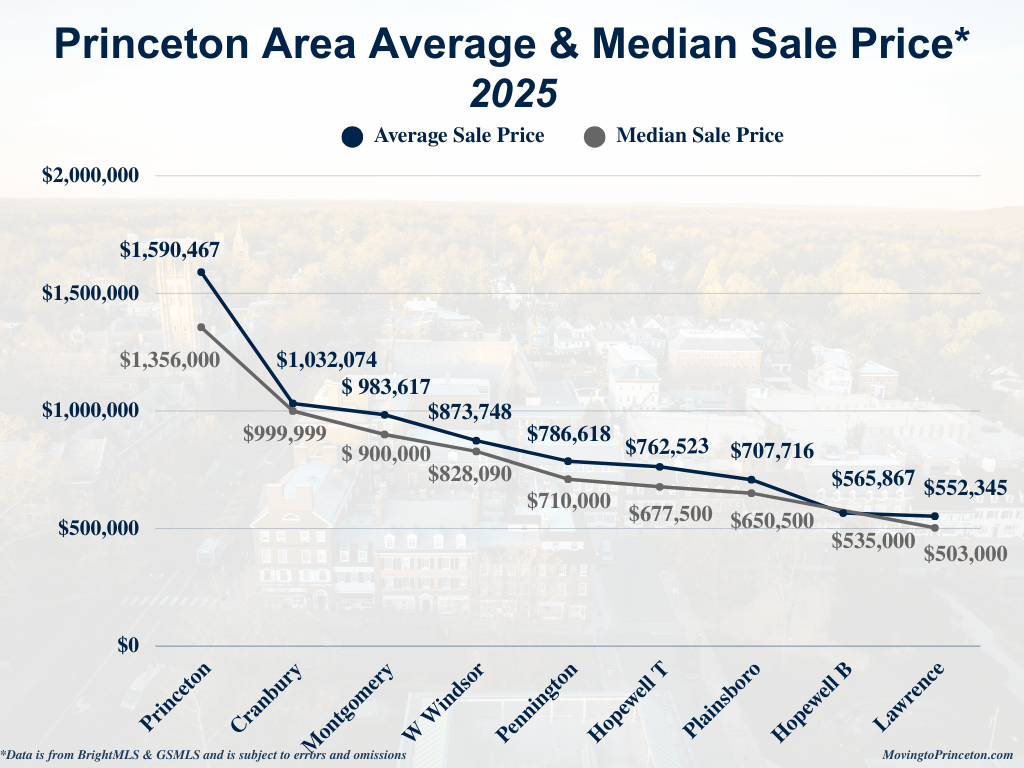

Looking beyond Princeton, Lawrence Township led the area in total Units Sold, followed by West Windsor and Hopewell Township.

Pricing, however, tells a different story. Princeton once again recorded the highest Average and Median Sale Prices in the surrounding area, followed by Cranbury and Montgomery Township.

As we move into 2026, both macroeconomic and local indicators point toward continued stability, with the potential for modest improvements in affordability should interest rates ease. Locally, buyer demand remains strong, and early signs suggest inventory may gradually improve. If these trends persist, the year ahead may offer a more balanced environment that continues to reward preparation and informed decision-making.

As always, real estate is local and nuanced. These broader market trends provide valuable context, but every neighborhood and property tells its own story. If you are curious about your home’s value or would like a tailored analysis of a specific market segment, I would be delighted to provide one.

Please feel free to reach out at any time as I am always here as a resource.