The Princeton November 2025 real estate data reflect a market defined by tight inventory and resilient demand. Year-to-date trends continue to underscore Princeton’s long-term strength, with prices reaching new highs and transaction volume outpacing 2024 levels.

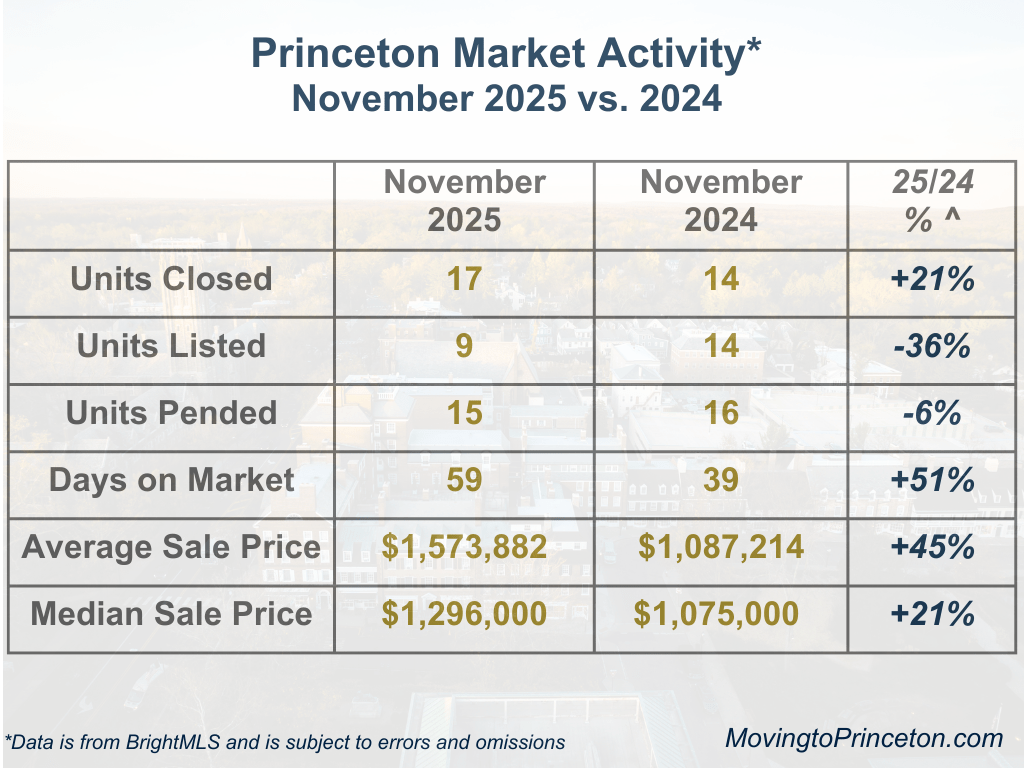

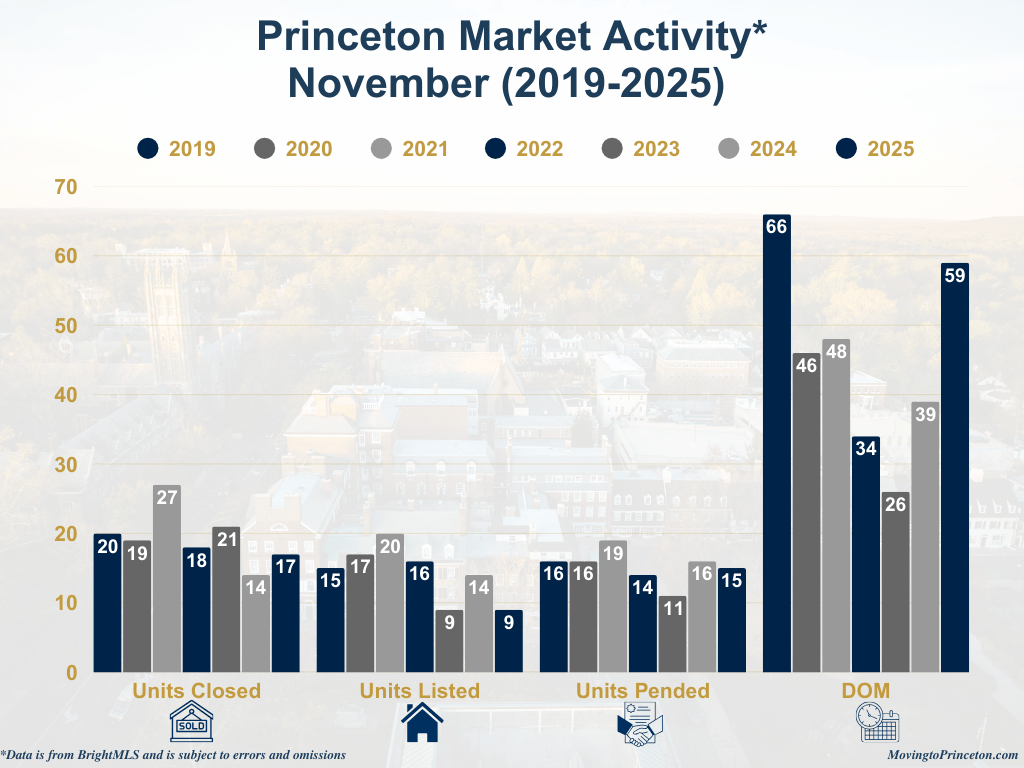

In November 2025, Units Closed increased from 14 to 17, representing a 21% year-over-year gain. At the same time, Units Listed declined sharply from 14 to just 9 (-36%), while Units Pended were effectively flat at 15 compared with 16 last year, remaining at historically strong levels relative to supply. The Average Days on Market (DOM) lengthened from 39 to 59 days (+51%), indicating a more deliberate buyer approach. This shift reflects greater buyer selectivity rather than reduced buying power, as motivated buyers continue to transact when they recognize value in well-presented and well-positioned properties.

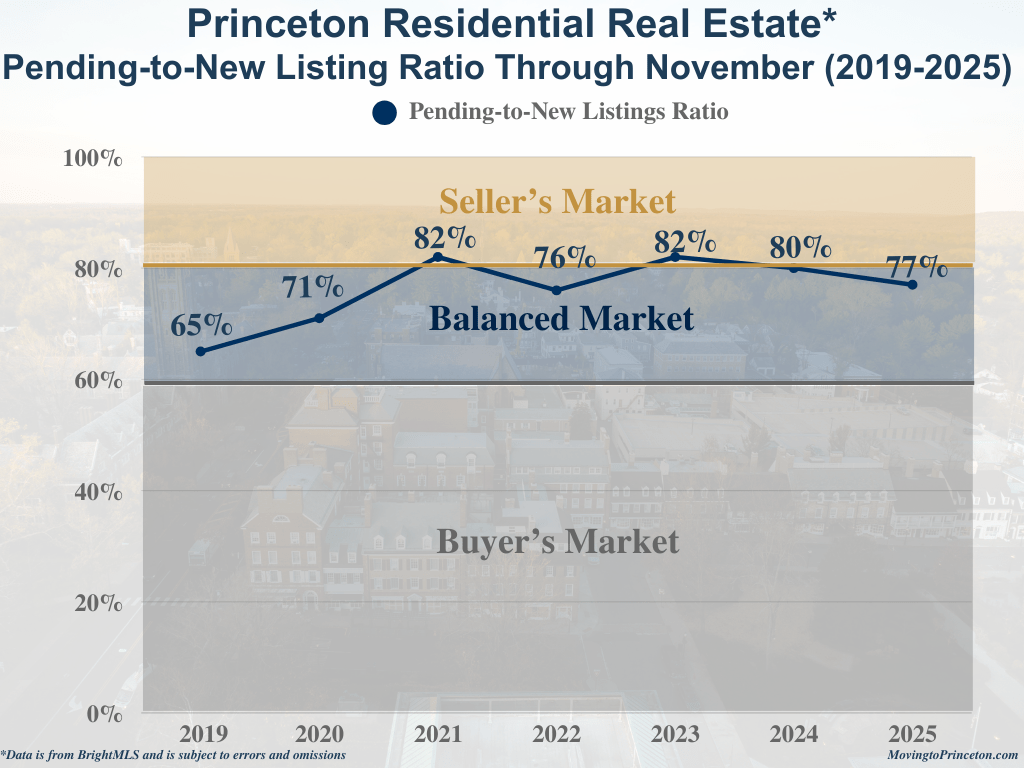

Pricing over this time has shown a clear upward trend. The Average Sale Price rose from $998,590 in 2019 to $1,573,882 in 2025, while the Median Sale Price increased from $857,500 to $1,296,000 during the same period. Although the Pending-to-New Listing Ratio has eased below peak pandemic levels, it remains near equilibrium, reflecting disciplined buyer behavior within a still-competitive market. The magnitude of this year’s price gains also reflects a higher concentration of upper-tier closings, underscoring that small monthly sample sizes can greatly amplify price movements.

On a year-to-date basis, Princeton’s real estate market continues to demonstrate resilience. Through November 2025, Princeton recorded 229 Units Closed, up from 214 over the same period last year, representing the strongest performance since 2022. Units Listed increased to 306 from 291 (+5%), while Units Pended rose slightly to 235 from 232 over the same January-through-November period in 2024. The Average Days on Market edged up to 42 from 35 in 2024 (+20%) but remains well below pre-pandemic norms. Combined these figures reflect a market that has cooled from pandemic extremes yet remains structurally strong and balanced.

Pricing reached new highs on a year-to-date basis. The Average Sale Price materially climbed to $1,618,246, and the Median Sale Price rose to $1,360,000. Properties are selling on average at 100.2% of Original List Price, confirming that demand continues to meet supply at strong price levels. The Year-to-Date Pending-to-New-Listings Ratio settled at 77%, slightly below 2024 but entirely consistent with a balanced market operating within a low-inventory environment.

What is going on in the greater Princeton area? Princeton continues to lead the greater area in both average and median sale prices, followed by Cranbury and Montgomery. Lawrence Township maintains the highest transaction volume, followed by Hopewell Township, West Windsor, and Princeton.

What is happening now in Princeton? There are 52 Active Units between $495,000 and $6,250,000, 11 Active Under Contract Units between $750,000 and $2,595,000, and 13 Pending Units between $360,000 and $2,100,000. Lastly, 6 new listings have been introduced thus far in December.

If a 2026 sale is on your horizon, now is an ideal time to assess value, timing, and positioning in preparation for the spring market. For buyers, this is an equally important window to refine a strategy that supports a successful outcome.

As always, real estate is local and nuanced. These broader market trends provide valuable context, but every neighborhood and property tells its own story. If you are curious about your home’s value or would like a tailored analysis of a specific segment of the market, I would be delighted to provide one.

Please feel free to reach out at any time as I am always here as a resource.