The Princeton October 2025 real estate data show that buyers are becoming more selective, sellers are aligning expectations, and well-presented, appropriately priced homes continue to attract buyer interest. Year-to-date results further underscore Princeton’s stability, with closed sales, listings, and pendings all modestly higher than last year, while average and median prices remain more than 50 percent above pre-pandemic levels.

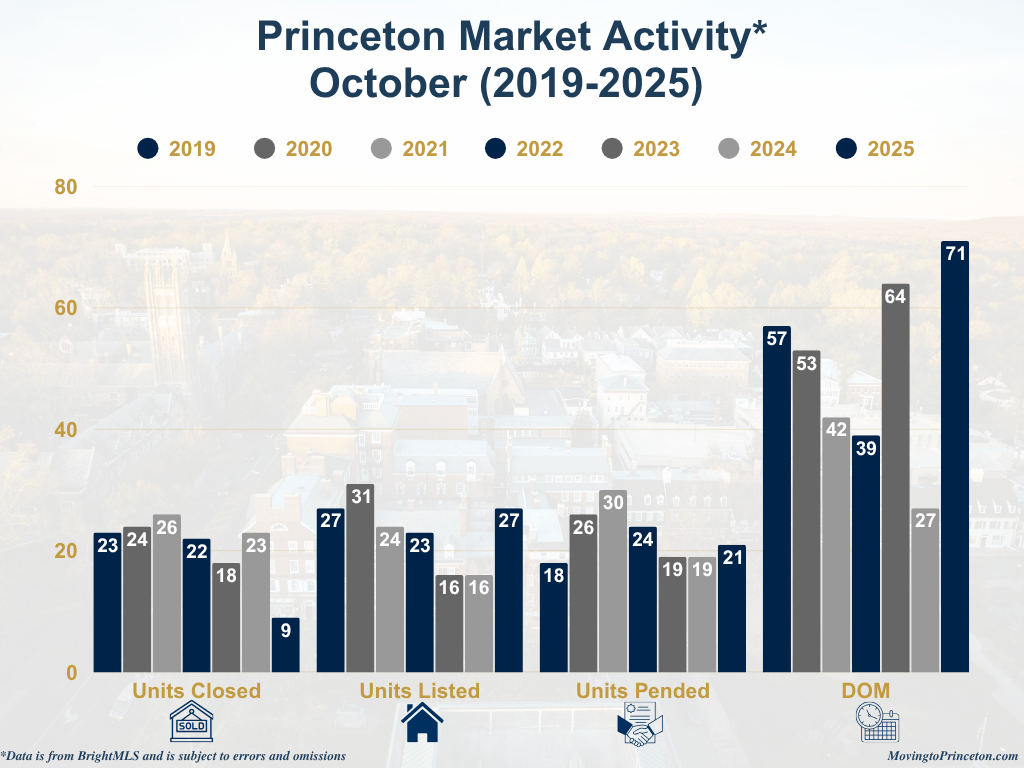

In October 2025, the market operated at a more measured pace compared with the previous year, providing buyers with more options amid steady demand. Units Closed declined from 23 to 9 (-61%), while Units Listed increased from 16 to 27 (+69%). Units Pended rose modestly from 19 to 21 (+11%), reflecting consistent buyer engagement even in a slower market. The Average Days on Market lengthened from 27 to 71 (+163%) as buyers took additional time to evaluate opportunities.

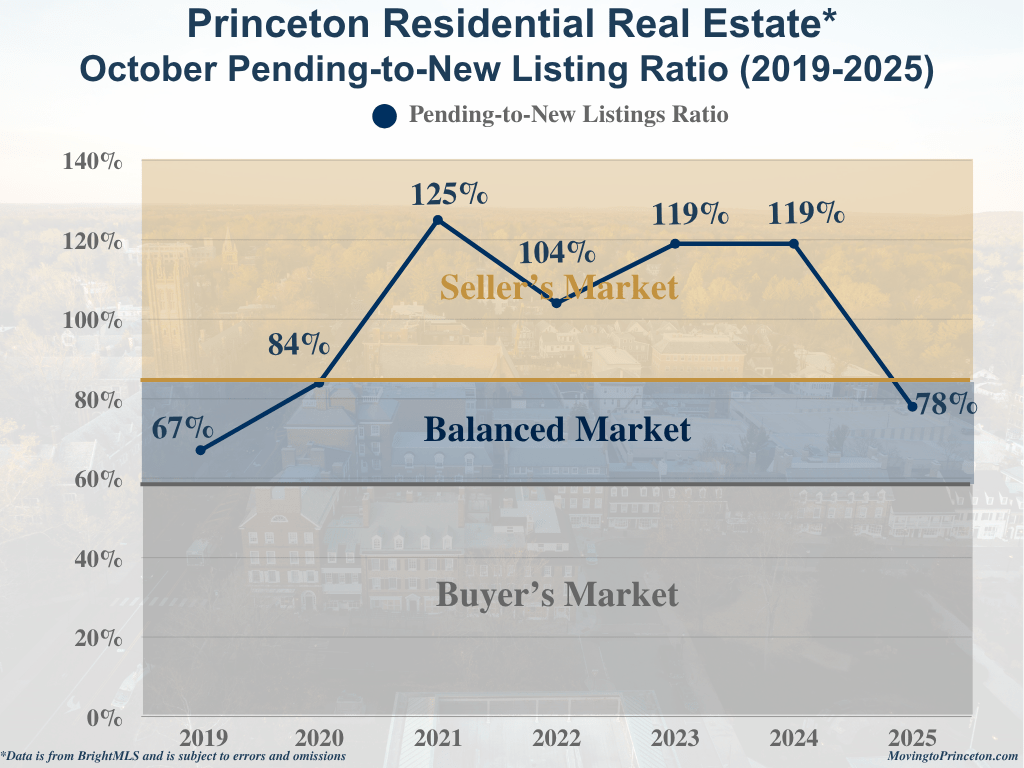

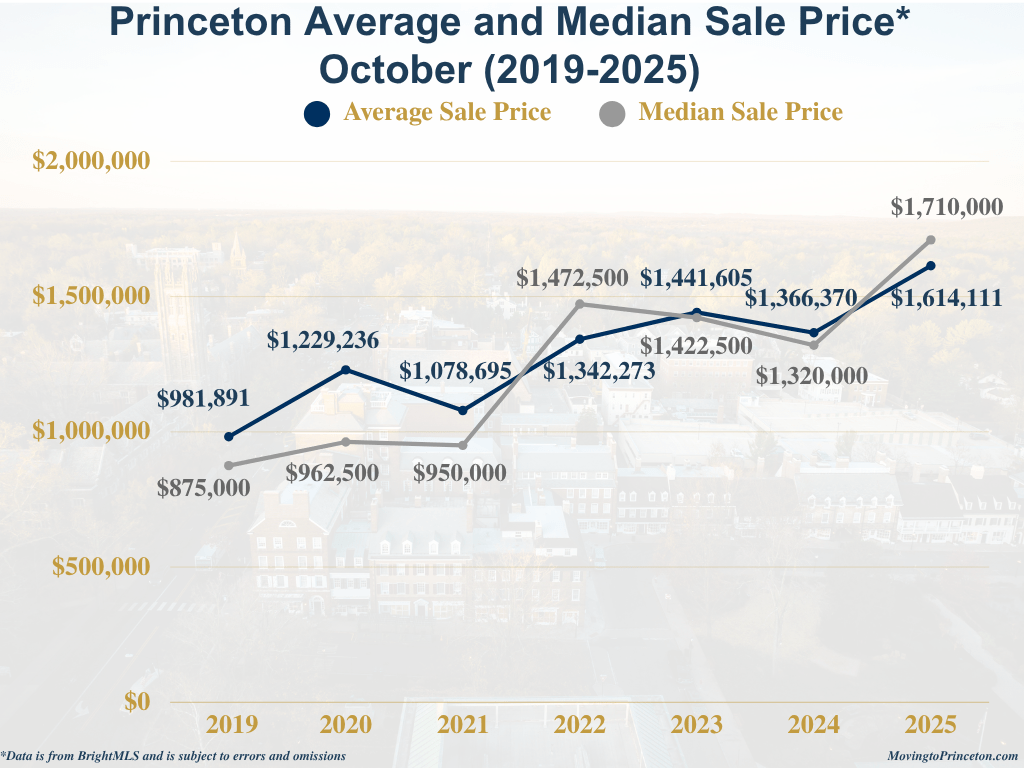

Despite lower sales activity, pricing remained exceptionally strong. The Average Sale Price increased 18% year over year to $1.61 million. In comparison, the Median Sale Price surged 30% to $1.71 million, an unusual inversion that reflects the small number of closings and a concentration of higher-end sales, which elevated the midpoint above the mean. The Average Sale-to-Original List Price eased to 95.6% from 103% last year, underscoring the growing importance of data-driven pricing strategies. With a Pending-to-New-Listings Ratio of 78%, buyer engagement remains steady as the market rewards sellers who prepare thoughtfully and price strategically.

The longer-term data for October reveals that Princeton’s real estate market has transitioned from a pre-pandemic period of stability to a surge in demand during the pandemic, and is now entering a phase of normalization. Since 2019, the number of Units Closed has fluctuated between 18 and 26 during the pandemic years, but dropped to 9 in 2025. Meanwhile, Units Listed have ranged from 16 to 31. Units Pending peaked at 30 in 2021 but have since stabilized at 21 this year. Additionally, the Average Days on Market have increased from a low of 27 in 2024 to 71 in 2025, further indicating that we are in a transitional market.

During this same period, prices have shown a clear upward trend. In 2019, the Average Sale Price was $981,891, with homes selling for 94% of their Original List Price. During the pandemic years, prices surged sharply, peaking at $1.44 million in 2023, when properties often sold above their asking price, averaging 102% of the Original List Price. By October 2025, the Average Sale Price reached a record $1.61 million, reflecting an 18% year-over-year increase, while the Median Sale Price climbed to $1.71 million. The lower Sale-to-List ratio of 95.6% indicates that buyers are becoming more discerning and less willing to pay above fair market value. These trends suggest that the market is becoming more balanced, rather than declining.

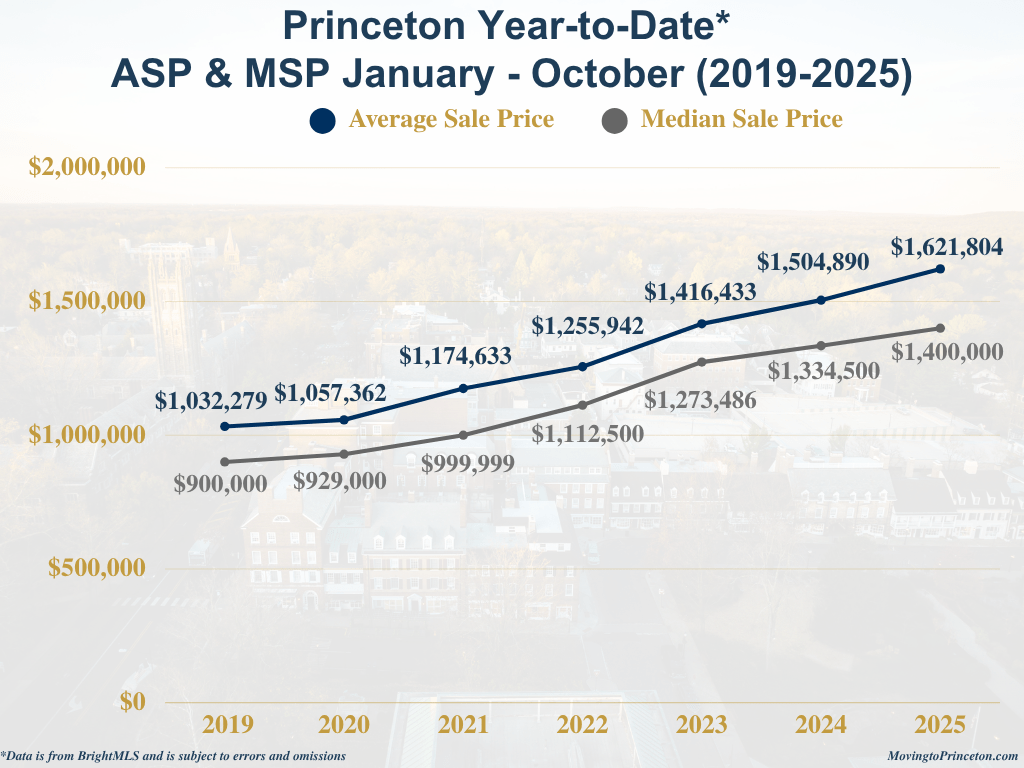

The YTD data further support Princeton’s broader story of resilience. Through October 2025, 212 Units Closed, up from 200 last year, representing the strongest total since 2022. New listings rose modestly to 296, compared with 277 in 2024, yet remain roughly 30% below 2019 levels, underscoring the ongoing inventory constraint. Units Pending also edged higher to 221 from 216 a year ago, while the Average Days on Market held steady at 40, nearly half the 2019 average of 72 days. These figures reflect a market that has slowed from pandemic highs but remains fundamentally strong, with balanced conditions and continued buyer engagement.

At the same time, pricing continues to illustrate Princeton’s long-term strength. The Average Sale Price rose to $1.62 million and the Median Sale Price to $1.4 million – both more than 50% higher than in 2019. Homes continue to sell at or near full asking price, averaging 100.4% of the original list price, reflecting a market defined by limited supply, steady demand, and sustained appreciation.

What is going on in the greater Princeton area? Princeton continues to lead the greater area in both average and median sale prices, followed by Montgomery and Cranbury. Lawrence Township maintains the highest transaction volume, followed by West Windsor, Hopewell Township, and Princeton.

What is happening now in Princeton? There are 62 Active Units between $360,000 and $6,500,000, 14 Active Under Contract Units between $700,000 and $1,985,000, and 18 Pending Units between $625,000 and $2,750,000. Lastly, only 1 new listing have been introduced thus far in November.

As 2025 begins to wind down, the market is poised for a measured winter season. Buyers are thoughtful, inventory remains tight, and opportunities still exist for well-positioned homes. For sellers considering a spring 2026 launch, now is the ideal time to evaluate pricing, timing, and presentation.

As always, real estate is local and nuanced. These broader market trends provide valuable context, but every neighborhood and property tells its own story.

If you are curious about your home’s value or would like a tailored analysis of a specific segment of the market, I would be delighted to provide one. Please feel free to reach out at any time as I am always here as a resource.