April 2025 delivered a strong year-over-year performance in closed sales and pricing while revealing early signs of a potential shift.

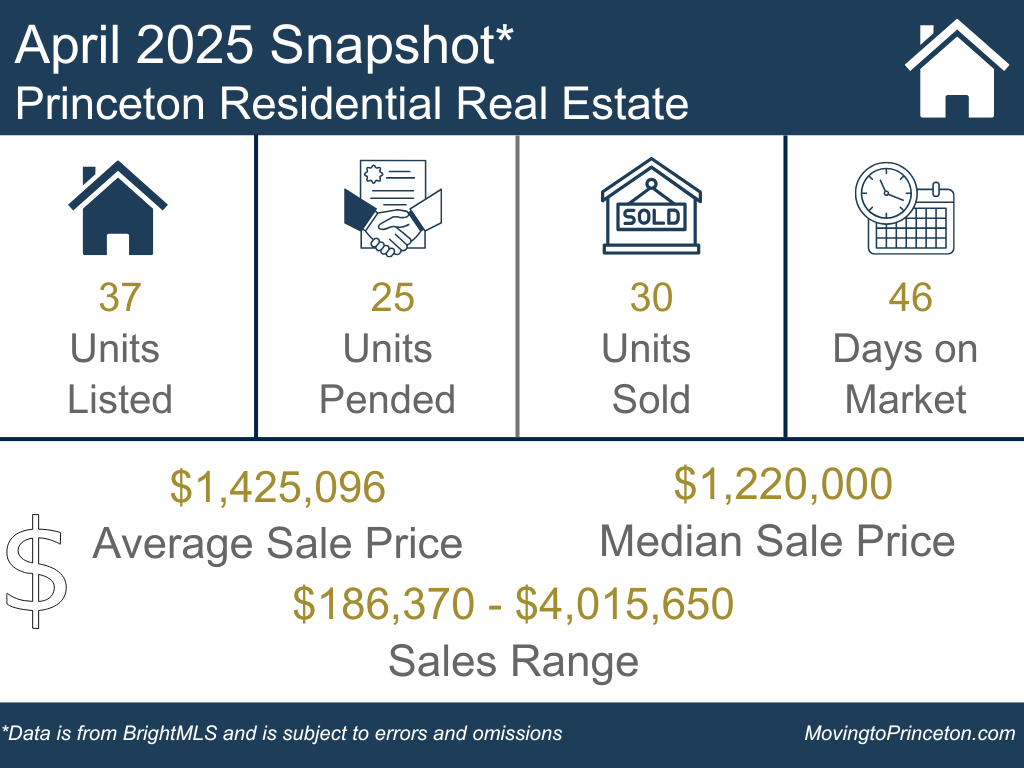

April 20205 Units Sold surged 131%, and the Average Sale Price rose 8% compared to April 2024. However, Units Pended dropped 46%, and Days on Market increased 18% over the same period last year. The spike in closed sales likely reflects strong follow-through on contracts written earlier in the year. In contrast, the slowdown in new contracts and longer market times may have been motivated by sellers testing higher prices and buyers adopting a more cautious, wait-and-see approach.

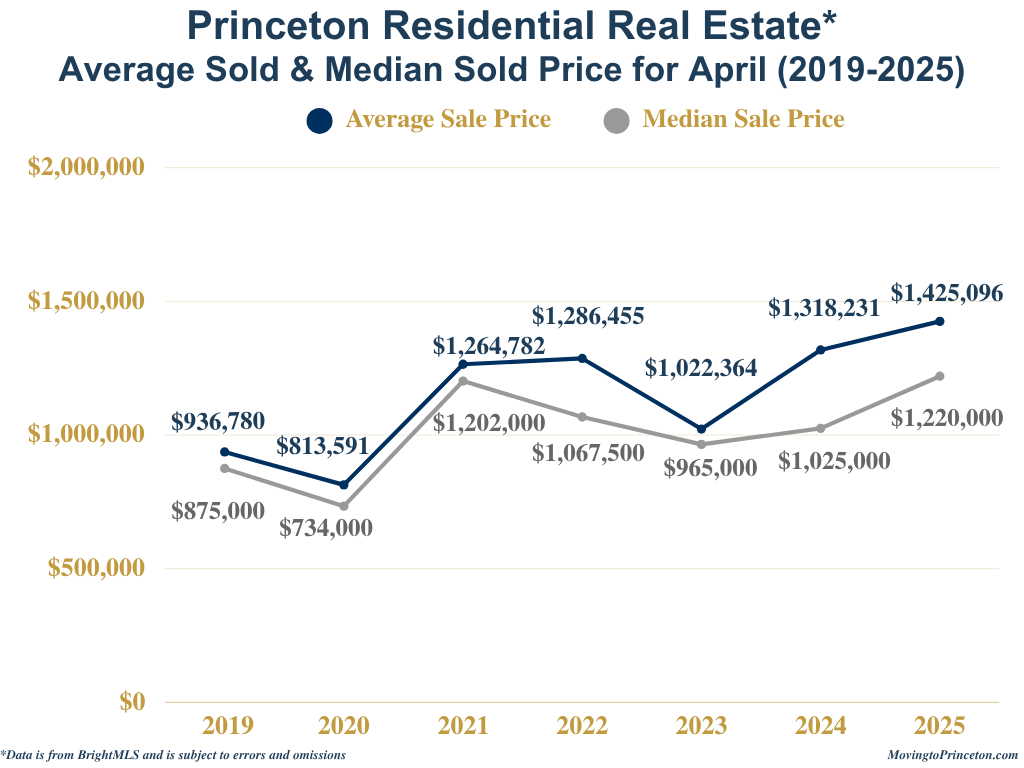

To put April’s numbers in a broader context, it’s helpful to consider how Princeton’s market has evolved over the past seven years. Compared to pre-pandemic norms, inventory this April remained historically low, while sales volume nearly matched the 2021 highs, a peak year fueled by pandemic-driven demand. Despite the strong pace of closings, the decline in new contracts in April 2025 may signal a market at an inflection point or reflect a seasonal pause. Whether this trend continues or picks up again will become clearer in the months ahead.

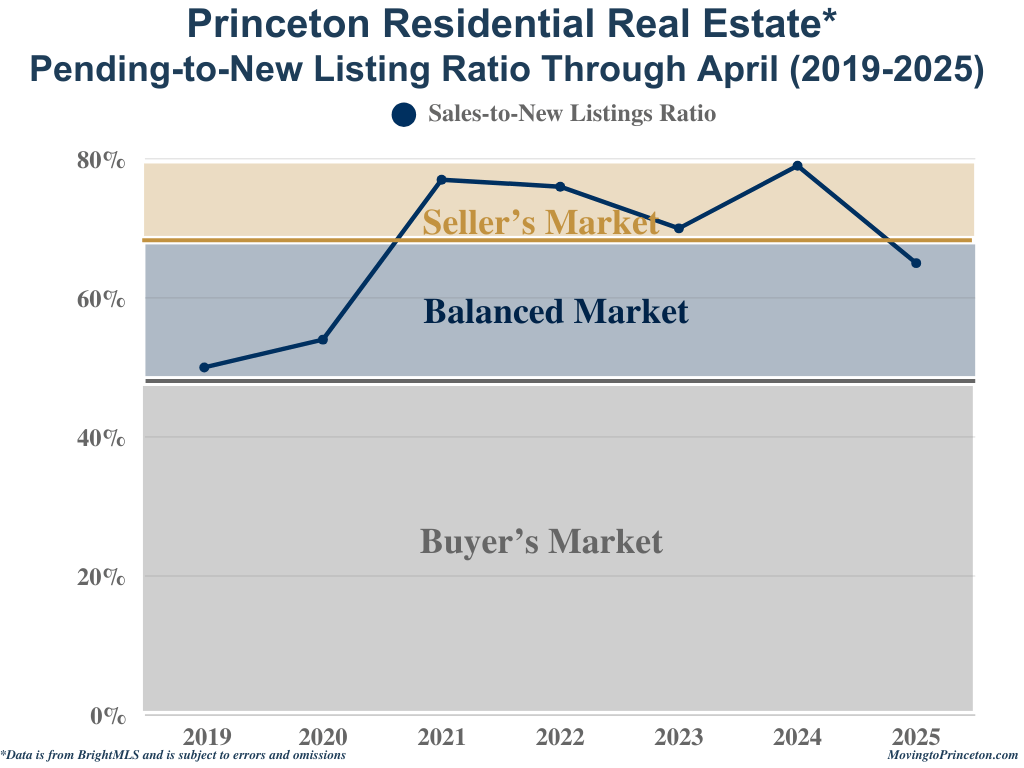

Because of the significant drop in Units Pended, I took a closer look at the Pending-to-Listing ratio over the past seven years to better understand the shift, especially since April 2025’s 69% ratio still reflects a healthy absorption rate. After reviewing the data, it’s clear that while the April 2025 ratio represents a notable decline from the previous year, April 2024’s 124% rate was an unusually high and unsustainable activity. As a result, the April 2024 Pending-to-New Listing ratio was more of an outlier than a benchmark.

April 2025 also brought new highs in both average and median pricing. These gains reflect continued competition for well-positioned, move-in-ready homes, particularly in desirable locations. Even as buyer behavior seems to be moderating, tighter inventory levels support price growth.

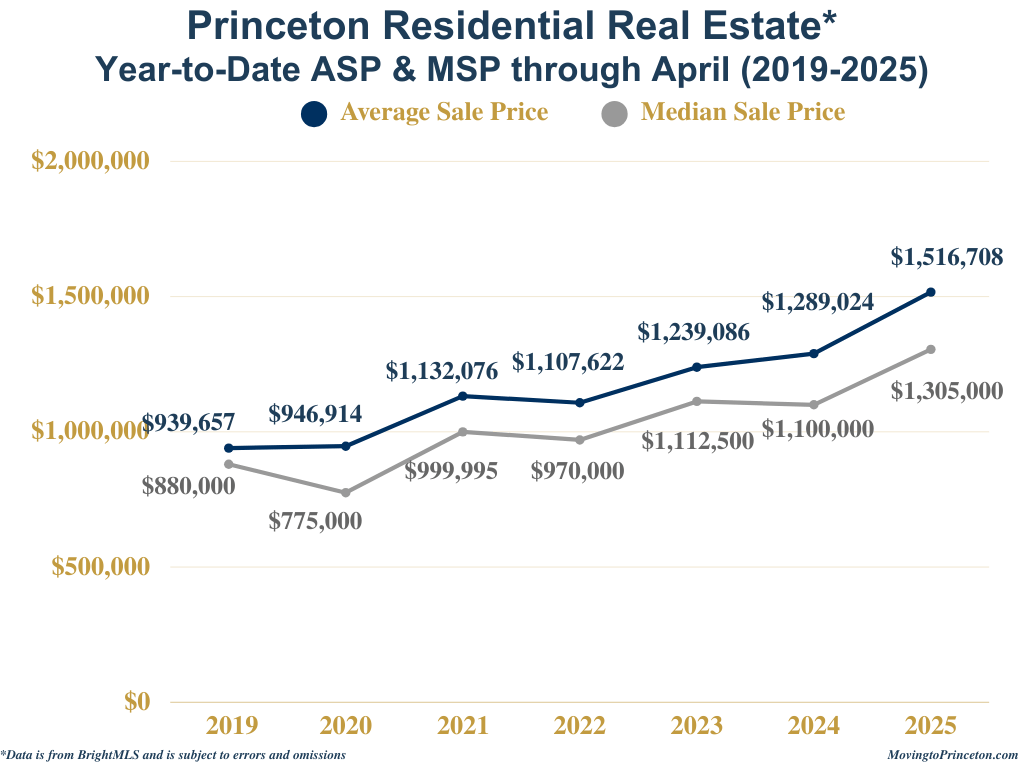

How is Princeton performing year-to-date? Compared to the same period in 2024, more Units Sold and Units Listed, but there was a slight dip in Units Pended, and the Days on Market were longer. In other words, while the market remains competitive, it is returning to a more balanced pace. Buyers seem to be approaching the market with greater scrutiny around value and pricing.

Speaking of pricing, the 2025 year-to-date Average Sale Price experienced another breakout year, with record highs in both average and median prices. Further suggesting continued buyer confidence as limited inventory is absorbed.

Now let’s take a deeper dive into the YTD Pending-to-Listing ratio. While the ratio of 65% in 2025 still represents a healthy absorption level, there is a noticeable decline from the high 70 %+ ratios seen over the past four years. This shift further suggests that while buyers remain active, they are approaching the market with greater selectivity and price sensitivity. Compared to the pre-pandemic years, when ratios hovered around 50%, demand remains strong, but the market is recalibrating.

What’s going on in the greater Princeton area? Through April 2025, Princeton leads the region in both Average and Median Sale Prices, followed by Cranbury and Montgomery Township. Hopewell Township recorded 66 sales, Lawrence Township had 63, and Princeton followed closely with 62. In terms of market speed, Hopewell Borough leads with an average DOM of just 16 days, followed by Montgomery and Plainsboro, each averaging 29 days on market.

What is happening now? Princeton has 61 Active Units between $750,000 and $6,500,000, 19 Active Under Contract Units between $645,000 and $3,950,000, and 33 Pending Units between $760,000 and $3,950,000 in Princeton. Lastly, 14 new listings have been introduced thus far in May – one is already under contract and two are pending.

As always, if you are thinking about buying, selling, or want to learn more about the Princeton area real estate market, please don’t hesitate to call (917-396-5880) or email me!