2023 was a remarkably resilient year for residential real estate in Princeton. Macro factors such as increased interest rates, higher inflation, and geopolitical risks affected the general residential real estate market. In contrast, micro factors like low inventory and buyer demand continued to move the market in ways that weren’t necessarily in tandem with national real estate headlines, further proving the hyperlocal nature of residential real estate. As a result of these market dynamics, Princeton residential real estate experienced fewer sales, listings, and contracts in 2023 than in 2022, with a higher Average Sale Price (ASP), Median Sale Price (MSP), and slightly longer Days on Market (DOM).

Before we dive into the data, it is essential to note that several sales occur outside BrightMLS, often in the high-end, and this data is not included in this analysis.

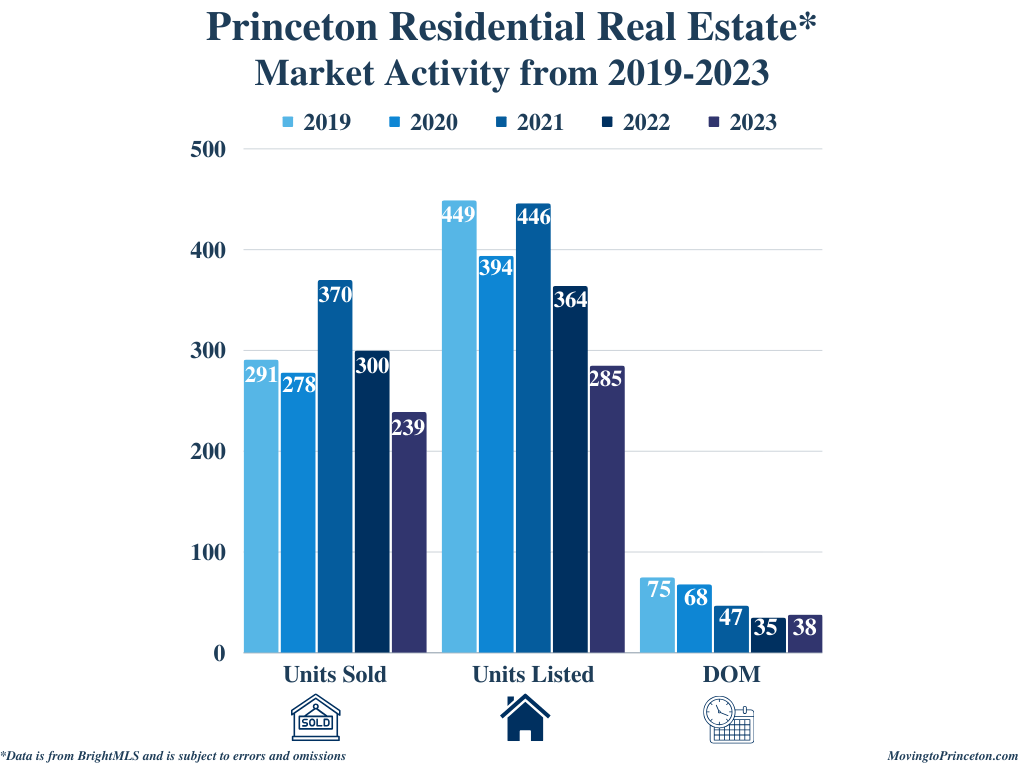

So, let’s begin. In 2023, Units Sold (239 vs. 300) and Units Listed (285 vs. 364) experienced an almost identical decrease, -20% and -22%, respectively, compared to 2022. When analyzing 2023 versus 2019, a pre-pandemic year, Units Sold also experienced a decrease (-18%, 239 vs. 291) but with significantly fewer Units Listed (-37%, 285 vs. 449) while selling at a considerably faster rate (DOM -49%, 38 vs. 75). Fewer Units Sold in 2023 compared to 2022 and 2019 because there were fewer Units Listed.

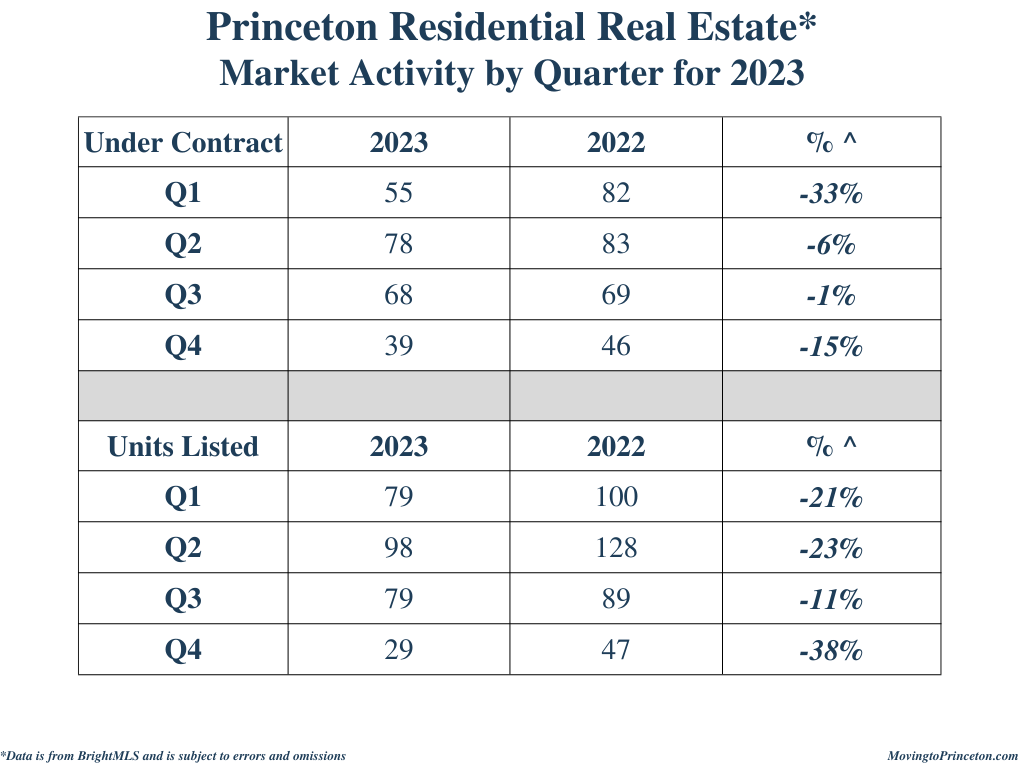

Now let’s review the Units Under Contract and Units Listed to understand what happened by quarter in 2023 compared to 2022. Every quarter experienced a smaller decrease in Units Under Contract relative to the decline in Units Listed, except for Q1, which saw a more significant reduction in Units Under Contract (-33%) relative to the Units Listed (-21%). While there were fewer Units Under Contract in 2023 compared to 2022 every quarter, most quarters outperformed, relative to the decrease in Units Listed.

Other interesting nuggets of information are that August saw the highest number of properties to go under contract, April had the most new listings, and houses sold the quickest in July and November.

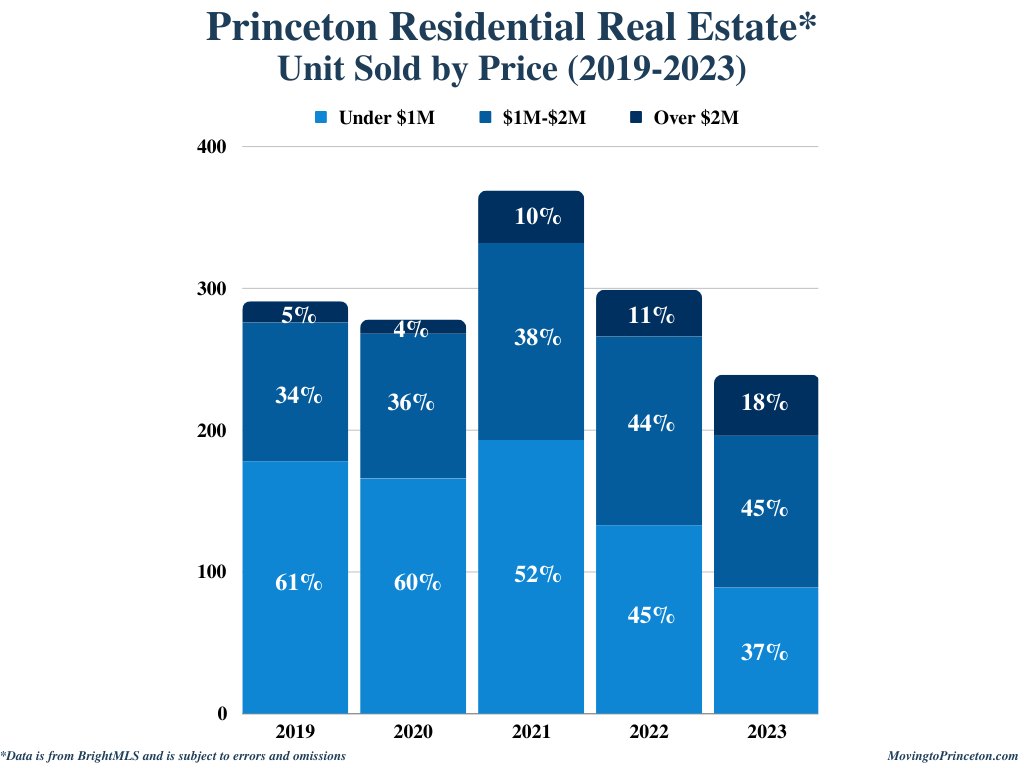

Given the lack of inventory, it is unsurprising that the Average and Median Sale Prices in 2023 increased compared to 2022. Both the 2023 Average Sale Price (ASP) and Median Sale Price (MSP) increased by +11%. When you compare 2023 to 2019, the 2023 ASP was up +37%, and the MSP increased +40%. The lower inventory in 2023 and continued buyer demand contributed to the increase in the Average and Median Sale Prices compared to 2022.

Another contributing factor to the higher ASP and MSP in 2023, relative to 2022, was the remarkable increase in Units Sold in the +$2M price range in 2023 compared to 2022. The shift in the Units Sold sales composition to a higher percentage of sales in the $2M price range also contributed to the increase in the Average and Median Sale Prices compared to 2022.

In summary, given the considerably lower inventory, it is impressive to see how well the Princeton residential real estate market performed in 2023 compared to 2022. I can’t help but wonder what would have happened if there had been more listings to sell.

What will 2024 bring? From a macro standpoint, all indications point to a more favorable interest rate environment, and the overall economy may experience the “soft landing” the FOMC was charting. From a micro standpoint, I see buyer demand continuing, and we are hopeful there will be more inventory. These dynamics may lead to an active and more balanced (between buyers and sellers) housing market.

As always, if you are thinking about buying, selling, or want to learn more about the Princeton area real estate market, please don’t hesitate to call (917-396-5880) or email!